Contributing to Your Employee Stock Purchase Plan (ESPP) FAQs

by Andy Kalmon

Nov 22, 2024

Generally speaking, if your company offers an ESPP and you are eligible to participate you should contribute to your ESPP. If you’re able to, you should max out your ESPP contributions to take advantage of the full discount.

While ESPPs are only available to employees of publicly traded companies, not all public companies give you the opportunity to participate in an ESPP.

Make More Money from your ESPP with Benny’s New Program

Benny 2.0 automatically manages your Employee Stock Purchase Plan (ESPP) to make you more money without disrupting your take-home pay.

How Much Should I Contribute To My ESPP?

Deciding how much you can comfortably contribute to your ESPP is a crucial and personal decision. To get started, we recommend reviewing your ESPP benefit since the structure of each company’s employee stock purchase plan can vary.

Before you determine how much to contribute to your ESPP you’ll want to know:

What discount is offered to employees

How much you can contribute to the plan

If you are automatically enrolled or if you have to re-enroll each period

If your plan requires a fixed dollar amount or percentage of your paycheck

You should then consider these important financial factors to help determine your ESPP contribution amount:

Contributions are automatically deducted from your paycheck.

Contributions are withheld from your after-tax income.

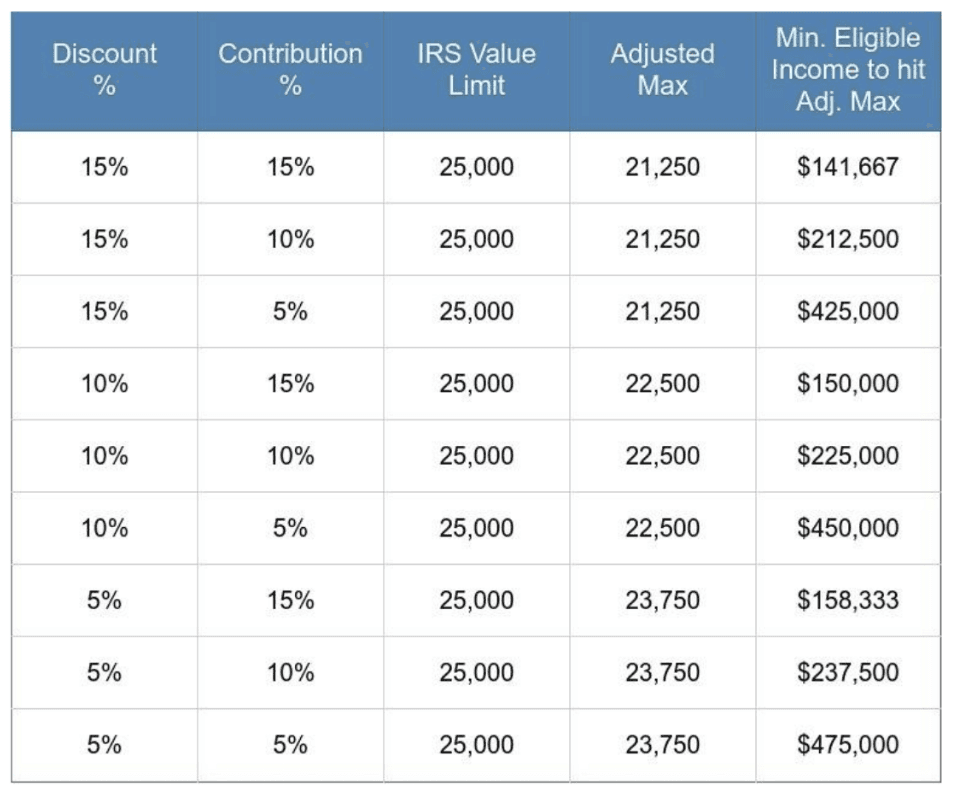

The IRS limits total contributions to $25,000 a year.

Keep in mind, the $25,000 amount is the value limit and not the Adjusted Maximum Annual Contribution Amount. We need to take your plan’s discount into consideration to get to the Adjusted Maximum Annual Contribution Amount. Once you hit this limit, your company will typically pause your automatic contributions until the beginning of the next calendar year.

We’ve done the math for you, use this table to see if you’ll reach the value limit.

For example, if your discount is 15% with a max contribution of 10% you will not max out your plan unless you make $212,500 or more. Most people won’t be affected…

The biggest advantage of ESPPs is the purchase discount, often up to 15%. If you’re able to, you should max out your ESPP to take advantage of the full discount.

Are ESPP Contributions Pre Tax? How Is the Money You Contribute to Your ESPP Taxed?

Your ESPP contributions are automatically deducted from your after-tax income and deposited into an ESPP holding account until they are converted to shares of company stock.

How Are My ESPP Shares Taxed?

ESPP taxes can be a bit tricky as money earned from them will be taxed in pieces and at two different times:

When you make contributions to the ESPP, taxes will be paid via regular payroll taxes. You don’t have to do anything here except know that you have already paid tax on your contribution.

When you sell the shares you will be taxed for the value received from the discount and any stock appreciation. This is the part you have to be aware of at tax time and there are two ways you can be taxed, qualified and nonqualified dispositions. The rate at which your tax varies depending on when you sell.

What Is A Qualified Disposition?

With a disqualifying disposition you will be taxed on the discount and any other gain at ordinary income tax rates.

This means you sold the stock

Within two years after the grant date

Within one year from the purchase date

Since tax situations and ESPPs vary, we recommend speaking with your employer, human resource manager, and financial advisor to assess your personal situation.

Does It Matter How Long I’ve Worked for My Employer When Contributing to an ESPP?

In some cases, yes how long you have been with your employer will matter when contributing to an ESPP.

Most plans have a waiting period before you can start contributing, but the exact time frame will vary by plan. For example, if your company has a six-month waiting period before employees can participate in their ESPP, you must wait six months from the date of hire or date of enrollment before your first contribution is taken out of your paycheck. If there is no waiting period, then you may make contributions on the same schedule as everyone else who participates in the plan.

If I Leave My Job, Can I Take My ESPP With Me?

If you decide to leave your employer, remember that you can no longer participate in its ESPP.

Any shares that you already own will remain yours, but there may be some restrictions on selling if your employer requires you to hold them for a certain period.

If you have contributed towards shares that you have not received yet, your employer will typically refund you the amount you contributed.